Currency conversion between the Indian Rupee (INR) and the Pakistani Rupee (PKR) plays a key role for people living near the borders, for traders, travelers, and families with ties in both countries. Despite political tensions, economic interaction through informal channels and remittances continues. Understanding how the Indian Rupee compares to the Pakistani Rupee, and what influences the exchange rate between them, is useful for individuals and businesses engaging in cross-border activities. Though both currencies originate from the same historical base, they have evolved differently under separate economic systems.

Overview of Indian Rupee (INR)

What is the Indian Rupee?

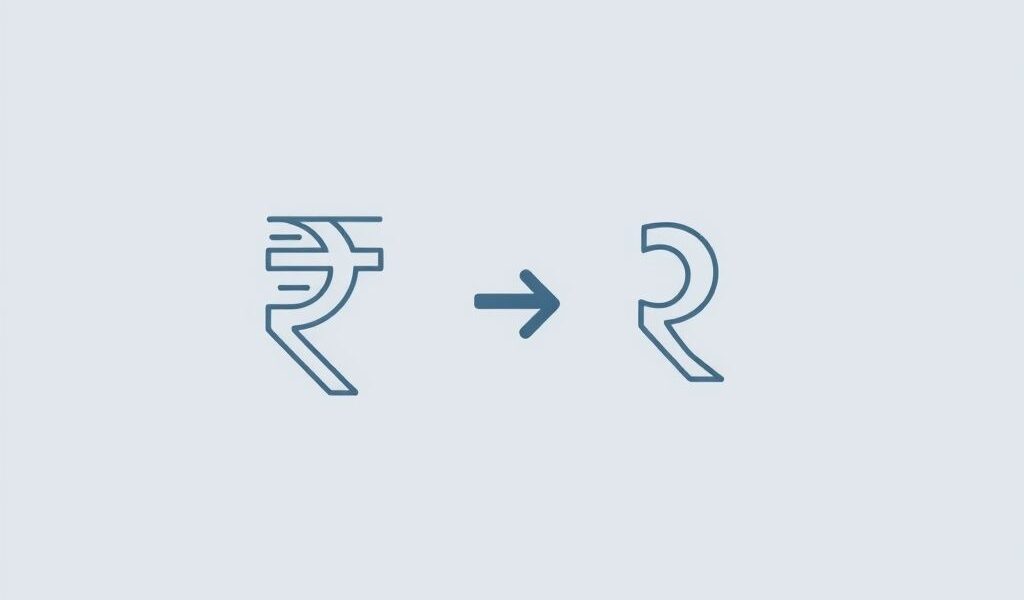

The Indian Rupee, abbreviated as INR and symbolized by ₹, is the official currency of India. Issued by the Reserve Bank of India (RBI), it is one of the most widely used currencies in South Asia. The Indian economy is among the world’s largest by purchasing power parity, and the rupee plays a significant role in trade across the region.

Factors Influencing INR Value

Several internal and external elements impact the value of the Indian Rupee:

- India’s inflation rate and interest rate policies

- Trade deficits and surpluses

- Foreign investment inflows and outflows

- Oil prices, as India is a major importer of crude

- Political and fiscal stability

Understanding the Pakistani Rupee (PKR)

What is the Pakistani Rupee?

The Pakistani Rupee, abbreviated as PKR and symbolized as Rs, is the national currency of Pakistan. It is issued and managed by the State Bank of Pakistan. Like the Indian Rupee, it is subdivided into 100 smaller units known as paisa, though these are rarely used in day-to-day transactions anymore.

Factors Influencing PKR

The Pakistani Rupee is influenced by:

- Exchange reserves and import/export balances

- IMF support and foreign aid

- Inflation and government borrowing levels

- Political uncertainty and macroeconomic reforms

Rupee to Pakistani Rupee: Currency Comparison

Current Exchange Rate

As of recent data, one Indian Rupee is equal to around 3.3 to 3.5 Pakistani Rupees. This rate is not officially fixed due to lack of formal trade or open currency exchange between the two countries. However, the informal or black market, remittance channels, or third-party exchanges often serve this conversion.

Why INR is Stronger than PKR

The relative strength of the Indian Rupee compared to the Pakistani Rupee can be attributed to:

- India’s larger and more diversified economy

- Higher foreign reserves and stronger export sectors

- More developed financial institutions and regulatory frameworks

- Consistent foreign direct investment (FDI) inflows

Currency Exchange Methods

Where and How to Convert INR to PKR

Due to political restrictions, there are no official currency exchanges between India and Pakistan. However, in some parts of the world such as Dubai, UK, or Canada where both communities live you can find third-party exchange services willing to convert INR to PKR.

- Informal Agents: Often found in border areas or diasporic communities, these agents help people send money or exchange currency through informal hawala systems.

- Online Transfer Services: Though direct INR to PKR conversions are rare online, some services may facilitate such transfers using an intermediary currency like USD.

- Forex in Third Countries: Currency exchange businesses in countries with large Indian and Pakistani populations may offer INR to PKR exchange through legal frameworks.

Things to Watch Out For

While converting currency unofficially or through intermediaries, users should be cautious:

- Beware of fake notes or fraudulent agents

- Check current rates before finalizing a transaction

- Understand legal implications in your region

- Avoid large conversions through informal channels to reduce risk

Historical Performance of INR vs PKR

Exchange Rate Trends Over Time

Over the last few decades, the Indian Rupee has generally appreciated against the Pakistani Rupee. In the early 2000s, the rate hovered around 1 INR = 1.5 PKR. Since then, due to inflation and economic instability in Pakistan, the PKR has depreciated faster than the INR. The current rate is more than double that, demonstrating the Indian Rupee’s growing strength regionally.

Key Historical Events

- 2008 Global Financial Crisis: Affected both currencies, but INR recovered faster due to stronger reserves.

- India’s Demonetization in 2016: Created temporary fluctuations in INR strength.

- COVID-19 Pandemic: Both currencies were impacted, but India’s quicker economic rebound helped stabilize INR.

Economic Implications of Currency Strength

Trade Between India and Pakistan

Although formal trade between India and Pakistan is currently limited due to political tensions, there have been periods when trade was more active. In such cases, the strength of INR over PKR means that Pakistani importers must spend more rupees to buy Indian goods, making imports expensive. Conversely, Indian exporters can benefit from this higher exchange value.

Remittances and Cross-Border Support

In some families with roots on both sides of the border, remittances are a lifeline. An INR to PKR conversion provides more value for recipients in Pakistan. For instance, someone sending ₹10,000 may be providing over Rs. 35,000 in Pakistani currency, depending on the rate and fees.

Political and Social Influences

Currency as a Tool of Diplomacy

Currency strength is often symbolic of broader economic health. In periods of tension, direct currency trade is restricted, which impacts border communities and small traders. Reopening formal exchange channels could promote peace and cooperation by improving economic ties.

Black Market and Its Effects

Due to the lack of formal exchange, a parallel black market exists where INR is unofficially exchanged for PKR. These markets are vulnerable to fraud, offer inconsistent rates, and may be used for money laundering or illegal trade, creating challenges for authorities on both sides.

Future Outlook of INR to PKR Exchange

Predicted Trends

Unless there is a major policy shift, the Indian Rupee is expected to remain stronger than the Pakistani Rupee in the near future. India’s economic growth, digital reforms, and higher foreign investment contrast with Pakistan’s debt burden and economic challenges, making this disparity likely to continue.

Potential Improvements

- Resuming diplomatic and trade dialogue could pave the way for official currency exchange

- Improved economic policies in Pakistan could help stabilize the PKR

- Use of cryptocurrency or digital payments may offer alternative cross-border transaction methods

The conversion from Indian Rupee to Pakistani Rupee involves more than just a financial transaction it reflects the economic health, geopolitical relations, and the daily lives of people connected across borders. While the Indian Rupee maintains a stronger position against the Pakistani Rupee due to structural advantages, the dynamics can evolve with changing political and economic landscapes. Whether for trade, remittance, or travel, understanding the INR to PKR exchange rate helps individuals and businesses make informed and strategic decisions. As global and regional conditions shift, staying updated on exchange rate trends will continue to be essential for those engaged in South Asian economic interaction.