Planning for retirement often begins with understanding how your future income will be calculated. One of the most essential aspects of this planning is learning about the pension calculation formula. Whether you work in the public sector, private industry, or a government job, your retirement benefits are likely determined by a specific formula that takes into account your years of service, average earnings, and a fixed multiplier. Understanding this formula can help you make informed decisions about your career, savings, and when to retire.

Understanding Pension Calculation Formula

A pension calculation formula is used to determine how much monthly income a person will receive after retirement. This formula varies depending on the type of pension plan, the employer, the country’s regulations, and individual employment agreements. However, most defined benefit pension plans use a relatively standard structure.

Basic Components of the Formula

In its simplest form, the pension calculation formula includes the following elements:

- Years of service How long the employee worked for the organization.

- Final average salary The average of the highest or last few years of earnings.

- Benefit multiplier A fixed percentage used in the formula to determine the portion of salary paid as a pension.

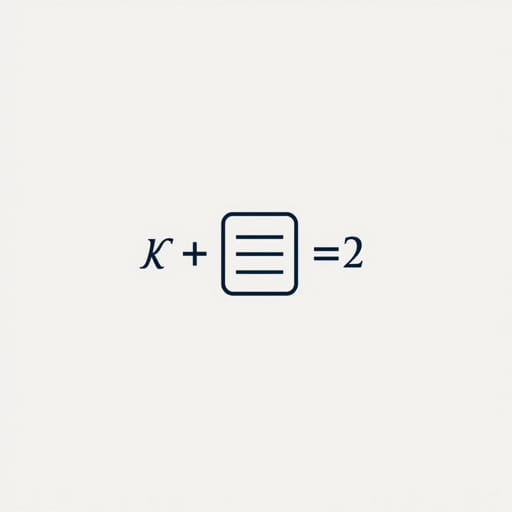

Here is the general formula:

Pension = Years of Service à Final Average Salary à Benefit Multiplier

This formula helps establish a predictable and stable income during retirement, which is why it’s widely used in traditional pension systems.

Explanation of Each Element

Years of Service

This refers to the total number of years an employee has worked for a specific employer or within a qualifying system. Longer service generally leads to higher pension payouts. Many pension plans require a minimum number of years often 5 to 10 before an employee becomes eligible to receive benefits, a condition known as vesting.

Final Average Salary

This is typically calculated based on the average of an employee’s highest-earning years. Different plans may use different methods, such as:

- Average of last 3 years of salary

- Average of highest 5 consecutive years

- Average of entire career earnings (less common)

The goal of using a final average is to reflect the employee’s peak earning potential, resulting in a fair pension amount.

Benefit Multiplier

The multiplier is a percentage, often between 1% and 2.5%, and it determines how much of your salary you receive as a pension for each year of service. A higher multiplier leads to larger pension payouts but is also more costly for employers. For example, a 2% multiplier means that for every year of service, the employee receives 2% of their average salary as annual pension income.

Example of Pension Calculation

To better understand how the pension formula works, let’s consider a hypothetical example:

- Years of service: 30

- Final average salary: $60,000

- Benefit multiplier: 2%

Using the formula:

Pension = 30 Ã $60,000 Ã 0.02 = $36,000 per year

This means the retiree would receive $36,000 annually, or $3,000 per month, for life (or as long as the pension terms apply).

Types of Pension Plans and Their Formulas

Defined Benefit Plan

This is the traditional pension model that uses a fixed formula. Employees are promised a specific retirement benefit based on the formula described above. The employer typically bears the investment risk and is responsible for ensuring funds are available.

Defined Contribution Plan

In contrast, defined contribution plans like 401(k) or public provident funds do not have a fixed payout. Instead, employees and sometimes employers contribute to an individual account. The final benefit depends on contributions and investment performance. No formula is used to guarantee income.

Hybrid Pension Plans

Some employers offer plans that blend both models, offering a basic guaranteed amount through a formula (defined benefit) and a supplemental account where investment returns apply (defined contribution).

Factors That Can Affect Your Pension Amount

Early Retirement

If you retire before the plan’s normal retirement age (often 60 or 65), your pension may be reduced. For each year you retire early, a percentage may be deducted to account for the longer payout period.

Cost-of-Living Adjustments (COLA)

Some pension plans include annual adjustments to help keep up with inflation. These increases are usually tied to consumer price indices and can significantly impact the value of your pension over time.

Part-Time Work or Career Breaks

If you worked part-time or had interruptions in your career, your years of service and average salary might be lower, resulting in a reduced pension amount.

Survivor Benefits

Many pension plans offer survivor or spousal benefits, which continue payments to a partner after the retiree’s death. Electing such options may slightly lower the initial pension to provide coverage for two lives.

Government Pension Calculation Examples

Public employees like teachers, police officers, and military personnel often follow standardized government formulas. For example:

- U.S. Federal Employees: The Federal Employees Retirement System (FERS) uses a formula of 1% à years of service à high-3 average salary. If retiring at age 62 or older with at least 20 years of service, the multiplier becomes 1.1%.

- India’s Government Employees: Pensions may be based on last drawn salary à years of service / 70, with various conditions and minimum service requirements.

- UK Public Sector: Final salary schemes and career average schemes use different methods, but most rely on salary and service years with accrual rates similar to multipliers.

Tools and Calculators

To assist with retirement planning, many pension providers and financial services offer online pension calculators. These tools allow users to input their salary, expected service years, and plan type to estimate retirement income. While they don’t replace formal pension statements, they provide useful forecasts.

Planning Around the Formula

Knowing how the pension formula works allows individuals to make better career and savings decisions. For example:

- Staying longer in service may significantly boost your pension due to the compounding effect of years and salary.

- Seeking promotions or raises in the last few working years may improve your final average salary.

- Understanding your plan’s early retirement penalties can help you choose the best time to retire.

The pension calculation formula serves as the foundation for determining how much income you will receive in retirement. By understanding how years of service, salary averages, and benefit multipliers come together, employees can make informed choices throughout their careers. This formula not only guides expectations but also provides a pathway to financial stability after leaving the workforce. Whether you’re in the early stages of your career or approaching retirement age, knowing how your pension is calculated is one of the most valuable pieces of financial knowledge you can have.